I currently have 11 credit cards (up from the 10 credit cards I wrote about just a few weeks ago, as I was just approved for a 200k sign-up bonus for the AmEx Business Gold card) and my Capital One Venture X card just renewed, with the $395 annual fee due December 2nd.

This is a card that I rarely use and is prime for me to discard it — below are the reasons why I rarely use the card (and the reasons why I think I’ll keep the card anyway):

Reasons that I rarely use my Capital One Venture X card

1. While 2 miles per $1 spent on every purchase is great, I’d rather earn American Express or Chase points.

Earning 2 miles per $1 spent is a great benefit for Capital One Venture X cardholders, but I already earn 2 points per $1 spent on all purchases with my American Express Business Plus card. Additionally, I earn 1.5 points per $1 spent with my Chase Freedom Unlimited card.

I value American Express and Chase points significantly higher than Capital One miles for a few reasons:

- I don’t know much about Capital One’s hotel transfer partners (Accor and Choice) and really value being able to transfer my American Express points to Hilton and Marriott and being able to transfer my Chase points to Hyatt, IHG, and Marriott. Also, I can transfer American Express points to Choice, making Capital One miles even less enticing.

- Capital One doesn’t have any exciting airline transfer partners that I don’t already get access to with American Express or Chase. Also, I’ve noticed that American Express and Chase offer more transfer bonuses to these partners than Capital One.

While Capital One earns 2 miles per $1 spent with no foreign transaction fee (unlike the American Express Business Plus and Chase Freedom Unlimited cards mentioned above), most of my spending abroad is on accommodations, transit, and food, and I can earn more than 2 points per $1 spent on those purchases with other cards that I have.

2. Although I love the 10 miles per $1 spent for hotels booked on Capital One Travel benefit, I rarely use it.

One of my favorite benefits of any card is the 10 miles per $1 spent that Capital One Venture X cardholders earn for hotels booked on the Capital One Travel portal. That said, I don’t really use this benefit much as, over last 1-2 years, almost all my of hotel stays have been booked with points or at Hilton or Marriott locations where I wanted to book directly with the hotel to get my status benefits.

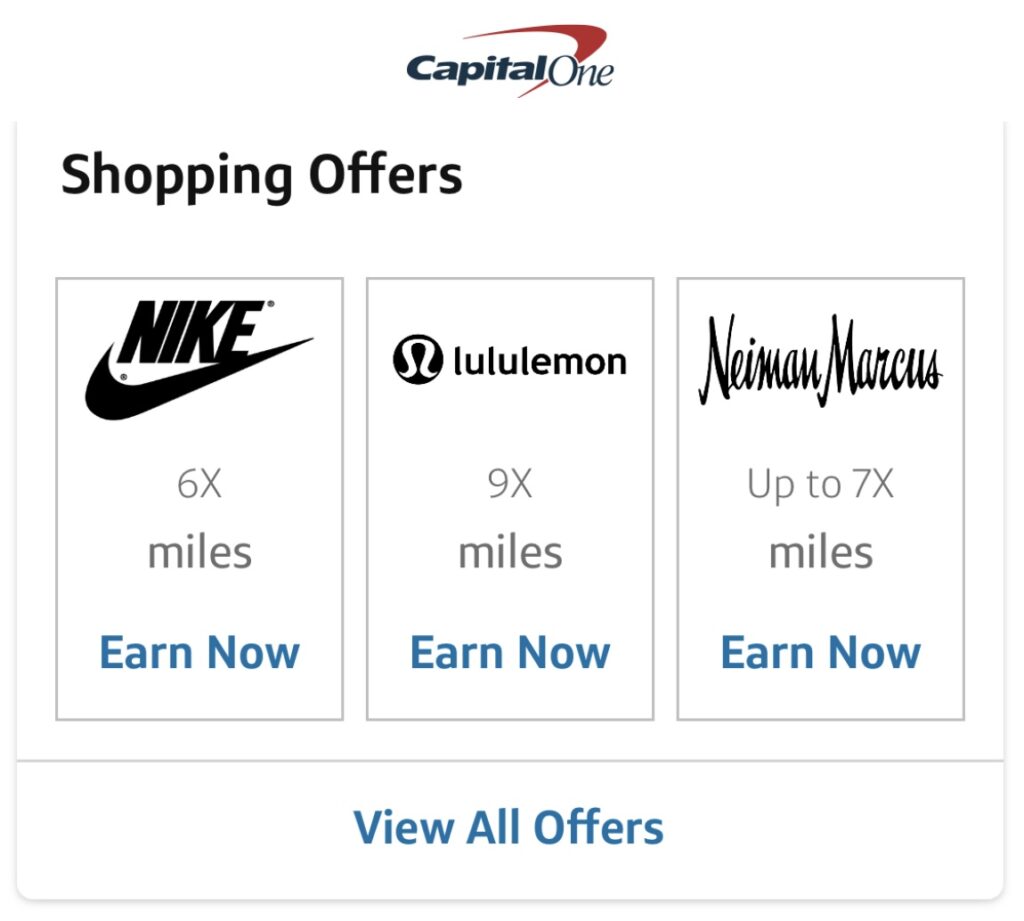

3. I’ve had bad experiences with Capital One shopping offers

I love taking advantage of American Express and Chase offers — for instance, I just received $12 for $25 spent at Stitch Fix with my Chase United Explorer card. While Capital One often has exciting shopping offers on its website and app, I’ve tried to use these offers twice and each time the purchase did not track. Each time the purchase didn’t track, I disputed it with Capital One and they made it very difficult for me to get the credit (in fact, Capital One only applied the credit for one of my two disputed purchases).

I have rarely run into similar issues with American Express, Chase, or even Rakuten, so this makes me not want to use the Capital One shopping offers, which otherwise would be a great feature.

Why I’ll likely keep my Capital One Venture X card (at least for another year)

1. I don’t want to transfer the Capital One miles that I currently have.

The biggest reason that I’m likely to keep my Capital One Venture X card is that I currently have 265,359 Capital One miles that I don’t feel like transferring out of my account. If I did close the card, I’d need to transfer the miles before closing my account down (and, if I did this, I’d probably send half of the miles to Air France and the other half to British Airways).

That said, I feel like paying $95 (see point 2) to keep these miles in my account and then spending the next year strategically spending those miles may be a better option.

2. With the $300 travel credit, the $395 annual fee is more like $95.

Because the Capital One Venture X card comes with a $300 annual travel credit which I’m sure I’ll use, I’m really only paying $95 for the year. Although I miss when the $300 annual fee was easier to use — now you need to book travel through the Capital One Travel portal instead of simply paying for travel with the card — I don’t mind using the Capital One Travel portal to book travel, particularly hotels.

3. I do really like the 10 miles per $1 spent benefit for hotels booked through Capital One Travel.

Although I rarely use this benefit, I love having the option of earning 10 miles for every $1 that I spend for hotels booked through the Capital One Travel portal and I hope to use this benefit more over the next year.

4. 10,000 bonus miles for anniversary

After I published this post, a reader kindly pointed out an important card benefit that I had forgotten — the Capital One Venture X card comes with 10,000 bonus miles on your anniversary. Given that the $395 annual fee is reduced to $95 after the $300 travel credit, the 10,000 bonus miles, even if valued at a measly $0.01 per miles (or $100), makes it so Capital One is essentially paying me to keep the card.

I think this is the kicker that will convince me to keep the card for another year.

Do you think think I should get rid of the Capital One Venture X Card? Let me know in the comments.

11 comments

You actually get a $300 travel credit and 10,000 miles on each anniversary with renewal and the $300 travel credit. I agree with you the card has limited value, but the real value is when you pair with the Savor Rewards card. As long as you hold the card, much like Chase Ultimate Rewards, the cash back from Savor Rewards becomes miles. So with the Savor Rewards/Venture X combo you pay one annual fee (Savor Rewards has none), and get 3x on dining, 3x on grocery stores, 3x on entertainment, and 3x on certain streaming and then 2x on anything else. I agree with you Venture Miles are less valuable, but unlike you I never transfer to any hotel program but Hyatt. I need all my transferable points for airline awards. TPG values Venture miles at 1.85cpm vs 1.80cpm for Thankyou points, 2.0 cpm for Membership Rewards and 2.05cpm for Ultimate Rewards. I don’t how they arrive at that because in my mind, the two transfer partners I find most useful with Ultimate Rewards were United and Hyatt. But Mileage Plus has been so devalued, I don’t see it having more value than LifeMiles or Aeroplan right now. It’s only advantage are the awards are still cancelable for free, and you can pay more miles to get awards on UA metal, but otherwise UA awards are higher than other programs

Thank you for pointing out the 10,000 anniversary miles! It shows how little I place value on Capital One miles (compared to Chase/AmEx) that I forgot about this benefit — but it’s the kicker and you’ve convinced me to keep the card. For United, I totally understand that that United miles aren’t what they used to be, but you still get outsized value compared to Delta when it comes to partner awards (and even earlier this year, I went to New Zealand on United miles for 100k United miles each way in business class, something I doubt I’d ever find on Delta). With so many similar partners, Chase = United + Hyatt and AmEx = Delta + Hilton, and with that I could see why TPG would value Chase Ultimate Rewards slightly higher than American Express Membership Rewards.

My experience is that Delta only provides affordable awards if you are outside the USA on premium cabins, especially Premium cabin. The thing Delta does have is sometimes the best award price (not cheap, but cheaper than the competition) on last minute awards to/from Mexico. Still, that’s an occasional award for me as sometimes the cheapest last minute award can be on AA or UA depending on the trip so I find UR is only useful for Hyatt primarily. I find AA miles (no transferrable points) and Aeroplan and Lifemiles are the most valuable for me with Flying Blue being the other. Aeroplan, Lifemiles, and Flying Blue all have multiple transfer partners.

Fly through dfw once and visit the lounge and you’ll never ditch this card. Im in dallas, has the amex platinum, i never use the centurion lounge any longer!

I’m kind of in the same boat. I prefer Chase points for sure, but the X card pays for itself and we really enjoy the Priority Pass benefits which, using authorized user cards, allows us to get all of our adult children and their spouses into lounges whenever they travel. Our whole dispersed family gets to enjoy that benefit.

That’s a great point about the authorized users! While it’s not a benefit I take advantage of and probably won’t in the next year, it’s a great reason to keep the card with how you use it.

Just like you, I found the venture x hotel partner choices are extremely limited. I personally never stayed at a Wyndham or Choices hotel even I’ve spent more than 2k nights at Marriott/Hyatt hotel rooms. And I also have Amex plat and Chase sapphire reserve-equivalent so basically I won’t need any Venture x travel partner redemption choices. The only thing I like now is that they are expanding their lounges and you can bring in up to two guests (unlike Amex centurion lounge where you have to spend >$75k to bring one guest for free)

It’s a no-brainer to keep the card for me.

First, I value the points at about 1.5 cents. The $300 credit is worth $250 to me – you don’t get points on the spend, so you lose the opportunity to get points when using it.

That said, the 10,000 anniversary points are worth $150 so the card is essentially free.

Second, we travel a LOT internationally and do a lot of shopping. No FTF matters for that, plus getting 2x on unbonused spend in places that don’t accept Amex domestically has value.

Finally, we have historically used a few of their more idiosyncratic partners that don’t partner with either Amex or Chase, like Turkish and TAP.

That makes sense, Robert! Almost all of my trips are international, but since I’m spending money almost entirely on food, travel, accommodations, and transit (not a big shopper by any means), the 2x unbonused spend doesn’t get me far, but it’s still a nice-to-have and I’ve never had an issue using my Capital One Venture X abroad. Domestically, I haven’t experienced a place not accepting AmEx in at least a year, but if I did I’d just use my 1.5x Chase Freedom Unlimited card (I’m personally just as happy with 1.5x Chase points as I am with 2x Capital One miles). Maybe I’ll try to take advantage of Turkish and TAP this year.

You make some great arguments. Interestingly you don’t bring up what for me is a pretty big plus of the card: lounge access. Entry into any of the Cap 1 lounges is pretty handy and unless they’ve changed it my business Venture X gets the Priority Pass restaurant credits as well, unlike the personal card version.

I was considering including lounge access, but I didn’t for a few reasons: (1) I’m based in LA and almost all of my flights are international, so I haven’t had the chance to experience a Capital One lounge yet, (2) I get Priority Pass with a couple of my other credit cards (even if the Priority Pass benefits can vary slightly between cards), and (3) most of my flights are business class these days with lounge access included and, if not, I have both Star Alliance Gold status and Centurion Lounge access. So with that, I’m not currently getting much value from the Capital One Venture X lounge benefit.