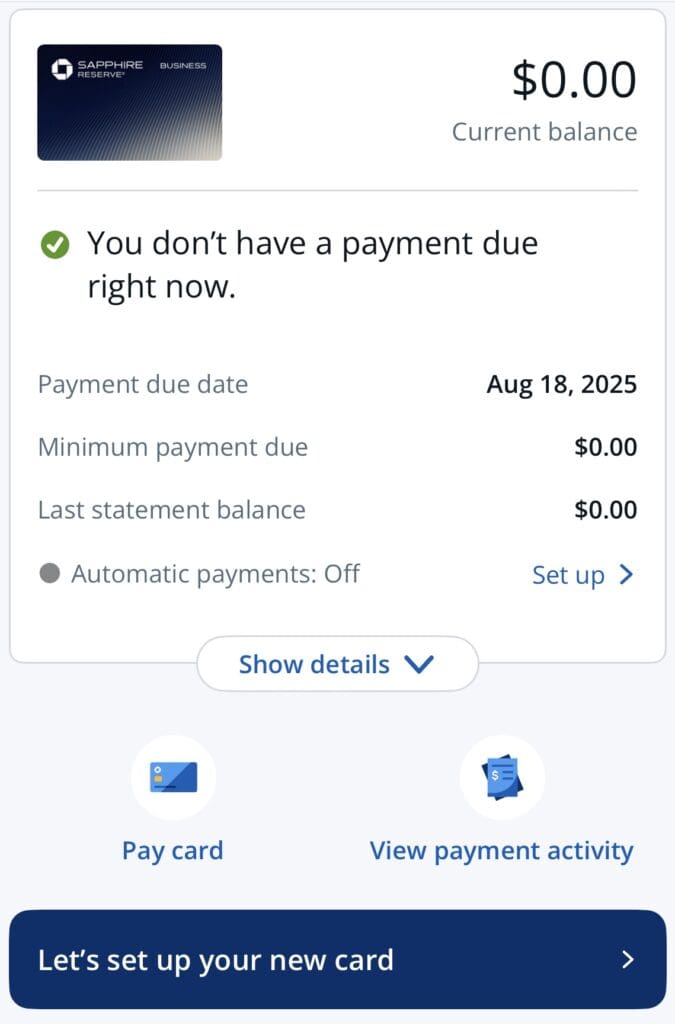

I just had my new Chase Sapphire Reserve for Business Card delivered this morning and I wanted to give my initial take on the credit card, as I’m likely one of the first people to get the card (I applied for it the day it was released and asked for expedited shipping).

Reasons that I got the Chase Sapphire Reserve for Business Card

While I’m actively trying to reduce how many credit cards I have (with the addition of the Chase Sapphire Reserve Business Card, I now have 13 cards), there are a few reasons I decided to get this card:

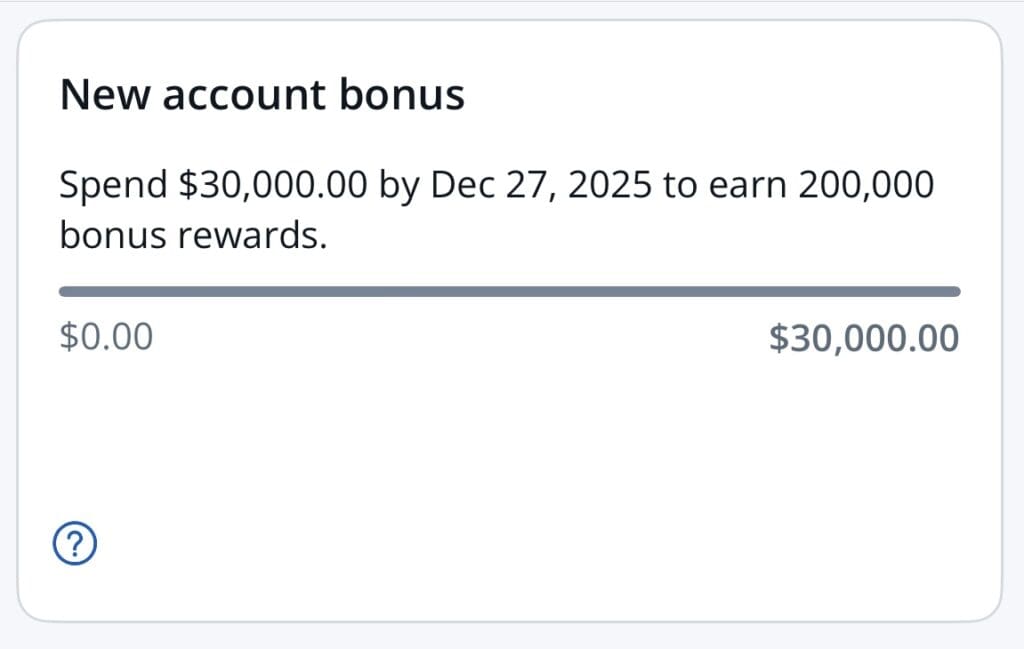

- The 200,000-point sign-up bonus. Although I already have ~650,000 Chase points, the 200,000-point sign-up bonus (after spending $30,000 in 6 months) was too good for me to pass up, even in-light of the $795/year annual fee. I was also tempted by the 100,000-point sign-up bonus on the personal version of the Chase Sapphire Reserve (with a $5,000 spend in 3-month spending requirement), but realized I’d get more value from the business card based on my spending patterns.

- It will be easy for me to more than recoup the $795 annual fee. Even though I’ll have to keep track of spend each month to do it (like ensuring I put three DoorDash purchases each month on the card to take advantage of the $25/month in DoorDash credits), I’ll be able to more than recoup the annual fee each year. Here are the credits that I’ll for sure take advantage of: $300 annual travel credit, $120 annual Lyft credits, $100 annual giftcards.com credit, $200 annual Google Workspace credit, $300 annual DoorDash credits. While I may be able to take advantage of other credits throughout the year, those credits alone get me $1,020 in value, meaning I’m making $225 just by having the card.

- There’s a new Chase lounge coming to LAX. I’m based in Los Angeles and almost all of my flights are international. At the time that I applied for the Chase Sapphire Reserve for Business card, I was considering getting rid of my Amex Business Platinum Card (and the Centurion Lounge access that comes with). Getting the Chase Sapphire Reserve for Business meant that whether I kept the Amex Business Platinum Card or not, that I’ll have access to a nice lounge when I fly out of the international terminal at LAX.

These were the main factors that got me to apply for the card and, so far, I’m glad I did. Now that I have the card and have used it already, here are my initial thoughts.

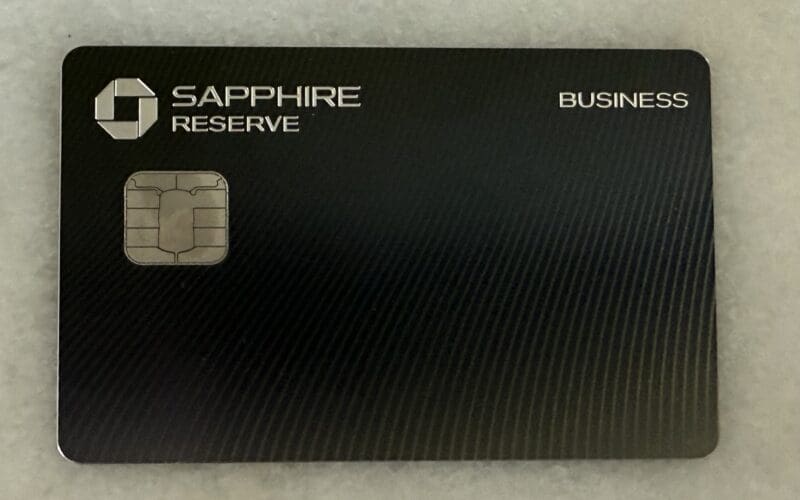

The card came in beautiful packaging that felt premium

At $795 per year, this is a luxury credit and Chase did a great job in packaging the card.

From the second that I opened it, I felt like I was unboxing a premium product (so I really want to give props to Chase for thoughtfully designing the packaging here).

Right after I opened the box, I was so excited to use the card, which I’d guess is the goal that Chase was aiming for with this packaging.

Easy to track the $30,000 spent requirement for the 200,000-point sign-up bonus

Chase has done a great job of making it easy to track how much you’ve spent to reach a credit card sign-up bonus over the last few years and the Chase Sapphire Reserve for Business Card is no exception.

To find the tracker, open your Chase app, select your card, and scroll down and you should see your spend tracker populated. I’m just so glad that I won’t otherwise need to keep track of my sending towards the goal (or the date that I need to hit by).

I’m glad that I was able to get the card before July 1st

One reason that I applied for the card right away and asked for expedited shipping was to get maximum value out of the card and take advantage of the following credits:

- $50 credit for using giftcards.com (you get two $50 credits each year, one from January-June and the second from July-December).

- $25 DoorDash credit for June (it was silly, but I had three Dashers on their way to my place today at the same time to take advantage of this credit).

- $12 Google Workspace (one of my Google Workspace bills is due in two days, so I wanted to move the spend to Google Workspace before July 1st)

- $12 Lyft credit for June

So thanks to getting the card before July 1st, I was able to get $99 in additional value on the card.

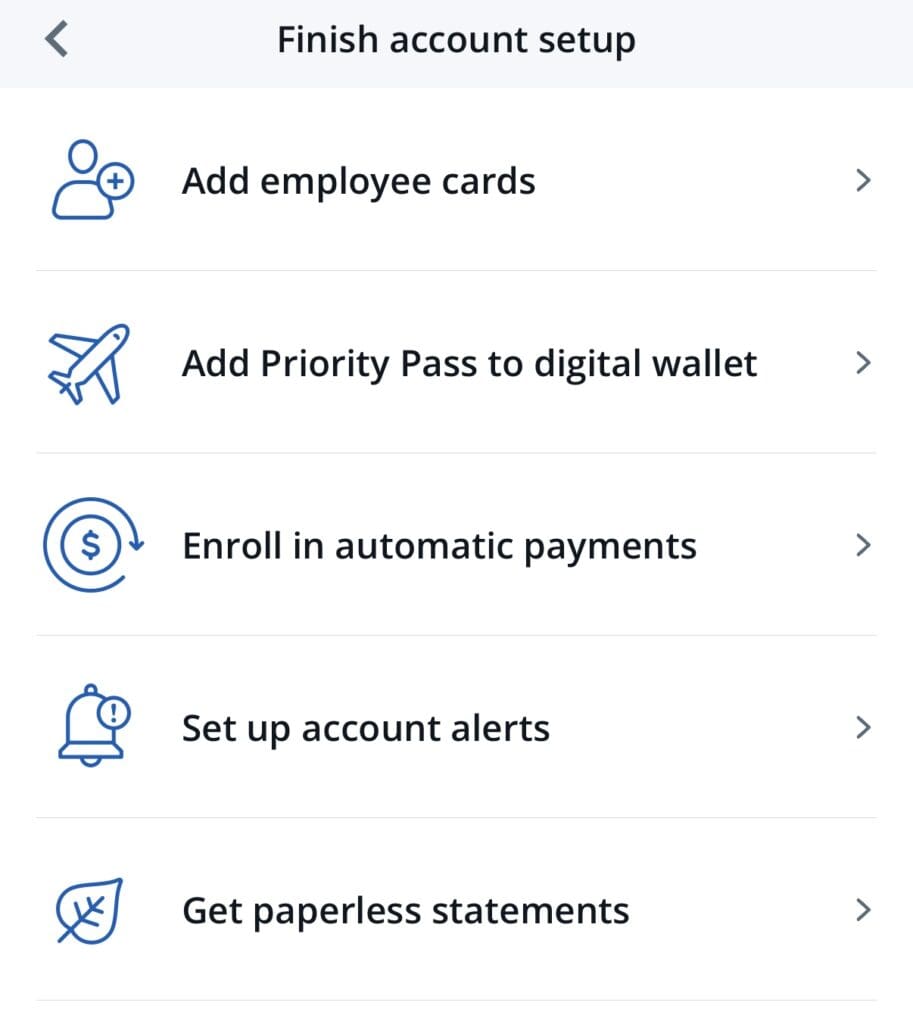

Priority Pass was surprisingly easy to set up

I have Priority Pass with a number of cards — so many that it’s hard to keep track of. With that, I wasn’t sure if I was going to sign up for Priority Pass with my Chase Sapphire Business Card, but they made it so easy that I decided to sign up and add it to my wallet.

Here’s how to sign up for Priority Pass with your Chase Sapphire Reserve for Business Card (and I’d imagine with the personal card as well):

Step 1: Open the app, select your card, and click “Let’s set up your new card.”

Step 2: Select “Add Priority Pass to digital wallet.”

From there, I got a prompt to add my Priority Pass card to my digital wallet. Piece of cake.

Easy to use the $50 semi-annual giftcards.com credit

To use the $50 semi-annual giftcards.com credit, you simply have to go to https://giftcards.com/reservebusiness, select the gift card, and pay for it with your Chase Reserve for Business Card. I selected the DoorDash gift card for $50 and applied it immediately to my account, so that one of my three DoorDash orders today was mostly paid for with my Chase Reserve for Business Card.

Helpful customer service representative

When I got the card, the first thing I did was call the Chase customer service line as I wanted to make sure I was enrolled in all of the offers I needed to be enrolled in (for instance, I didn’t want to spend $50 on giftcards.com only to later find out I didn’t enroll in that benefit).

Even though it’s the weekend — when credit card companies don’t often have their A-team working — the woman I spoke to was very nice and helpful, though admittedly it’s such a new card that she’s still learning the ins-and-outs as well.

She was able to answer the questions I had, which also led to a great first experience with the card and Chase.

Getting DashPass and applying my DoorDash credits wasn’t easy

I already had DashPass through another Chase card, so I figured this might be a bit difficult (and I was right). Basically, I tried to switch my DashPass to be under my Chase Sapphire Business Card on the doordash.com website, but was unable to (I could tell it wasn’t working because when I went to checkout for an order with Target, the $10 credit wasn’t showing).

I called DashPass and was lucky to get a helpful agent, but since the card is so new she also wasn’t exactly sure what I should do and spent about 10 minutes talking with one of her supervisors. I wish I could tell you the exact steps they took to get my DashPass switched to my Chase Sapphire Reserve for Business card, but all I know is that at the end of the call it was finally working.

My hope is that as more people start trying to switch their DashPass over to the card, they’ll make it easy to self-serve so that people won’t need to call (or maybe others already don’t and I was just not great at setting it up).

One thing I am wondering is if I’ll still get my $10/month DoorDash credit with my Chase United Explorer card now that I’ve switched my DashPass over, which I’ll out in a few days.

I’m excited for the Chase Sapphire Reserve Lounge at LAX

Although I decided to keep my Amex Biz Platinum card (as they offered me a 15,000-point retention bonus) and will have access to the Centurion Lounge, the Centurion Lounge at LAX isn’t exactly my favorite, so I’m really looking forward to checking out the new Chase Sapphire Reserve Lounge at LAX once it opens.

If the Chase Sapphire Reserve Lounge at LAX is as nice as I think it will be and there isn’t an overcrowding/wait issue, then this may be reason enough for me to keep the Chase Sapphire Reserve for Business Card over the Amex Business Platinum card.

Earning 4x points for flights and hotels

Since a lot of my travel spend is on flights and hotels, I am excited that this card earns 4x in these categories, with a $300 annual travel credit to boot. While I currently earn at least 3x points for flights and hotels thanks to my Chase Ink Business Preferred card, I’m not one to say no to extra points.

What I’m not excited about with the card

While I am mostly excited about this card, here are the few things that I’m not excited about:

- Couponing. While I’ve so far loved my experience so far and am very much looking forward to adding 200,000 Chase points to my balance, the one thing I’m not looking forward to is couponing. Every month, I need to remember to place three DoorDash orders using my Chase Reserve for Business Card, every 6 months I need to remember to order a gift card on giftcards.com, every month I need to remember to pay for Lyft using the card, etc.

- Not earning 3x for food or 4x for travel spend. The Chase Sapphire Reserve personal card earns 3x for food, but the business card only earns 1x for food (and instead, the business card has 3x for online advertising purchases). Since I don’t currently buy online ads for my business, 3x for food would have been much better for me — that said, I get 4x for food with Amex Business Gold card. Also, I wish the card didn’t earn 4x only for flights and hotels but for travel as a whole (that said, I have the Chase Ink Business Preferred that earns 3x for travel, so I can just use that card for things like train tickets, tour guides, or even paying for a safari).

- The $795 annual fee. Even though I am getting more than $795/year in benefits, I’m not looking forward to having another annual fee expense (much less, one this high). As a business card, I do at least get to deduct the fee as a business expense, which lowers the fee to $368 if you include my tax savings.

Bottom line

I am so far impressed and excited about my new Chase Sapphire Reserve for Business Card. This is actually my first Chase Sapphire Reserve Card, and I think Chase has done a great job of packaging this card as a premium product and, for the most part, has made it easy to setup and use the card and its benefits.

Are you getting either the Chase Sapphire for Business Card? Let me know in the comments!

3 comments

The Centurion lounge at TBIT sucks because it closes at 10 pm. Luckily I’m always flying J or F so I have access to the alliance lounges. Enter when I want not having to worry about the 3 hour rule. Getting the Ritz card for Sapphire lounge access and will be downgrading my reserve. I’m sure the lounge will be great when it opens and soon will be overcrowded like all the other bank lounges drawing heavily from AA and DL pax. At least with the Ritz card it will be a tertiary feature and not the focus like the sapphire cards. So if I can’t get in diverting to the AA lounge or an alliance lounge won’t feel like a loss. Increasingly the bank lounges are feeling like a consolation prize for those who can’t get into an airline lounge. Just looks silly lining up to get into a lounge unless there are no other options available.

is it the lighting of the photo or is the card actually black?? I thought it was blue?

Wish I could answer, but I’m colorblind — but maybe one of my other readers will weigh in.