In recent years, Delta, United, and American have instituted a rule that in order to qualify for elite status, you need to spend a certain amount of money on flights through the airline. American Airlines calls these Elite Qualifying Dollars (EQD).

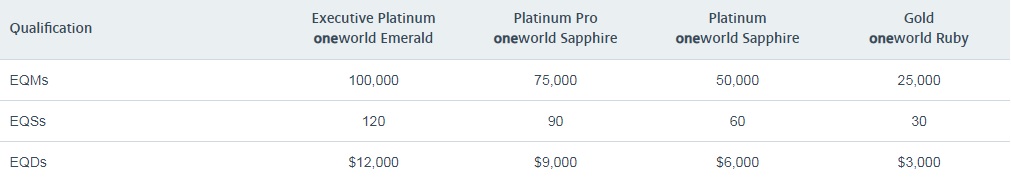

Below is a chart for how to qualify for American elite status:

So, for example, if you wanted to earn Platinum status, you would need to fly either 50,000 miles or 60 segments and you would need to spend $6,000 EQD’s.

The EQD requirement is a major hassle for travelers like myself who are able to amass this much travel by spending very little (I’ll get 50,000 miles on United this year with EQD’s of around $1,200).

But, luckily, all three airlines (Delta, American, and United) had a workaround — if you spend at least $25,000 on a co-branded credit card, the EQD requirement would be waived until at least the third-highest-level status (Platinum Pro on American and Platinum on United).

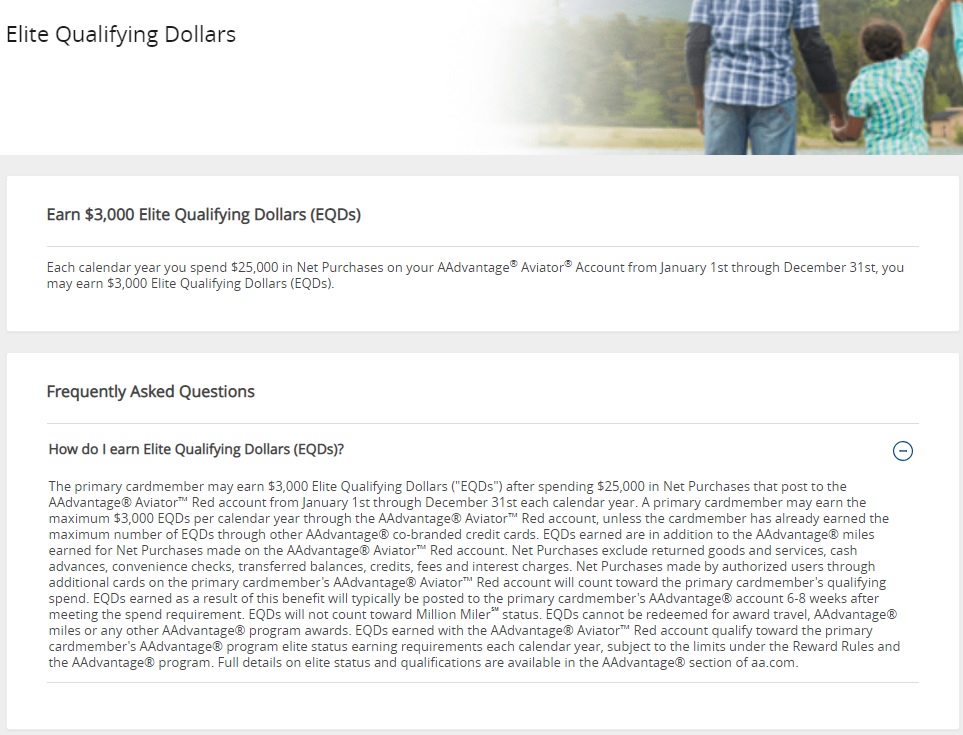

I’m trying to decide if I want to keep my American Airline Barclaycard, so was looking at the benefits and noticed a major change from American: now, if you spend $25,000 on the Barclaycard, you will only be given an EQD of $3,000 (enough for the lowest Gold status), but nothing more.

This is a disappointing move from American and will make it so many loyal American customers will no longer be able to obtain status above Gold.

I’m still going to keep the card because of 3 other benefits that it offers: priority boarding, 10% back on miles spent on award flights, and great award travel availability. But my fear is that those benefits may disappear in the coming months as well.

Will American slashing the EQD waiver on the Barclaycard affect you? Let me know in the comments!